MBCC TH 10th March'23 - "So you think Commercial Real Estate issue is isolated? 550bps of tightening in 12 months will cause a lot of skeletons to come out of the closet, but the Fed is trapped!"

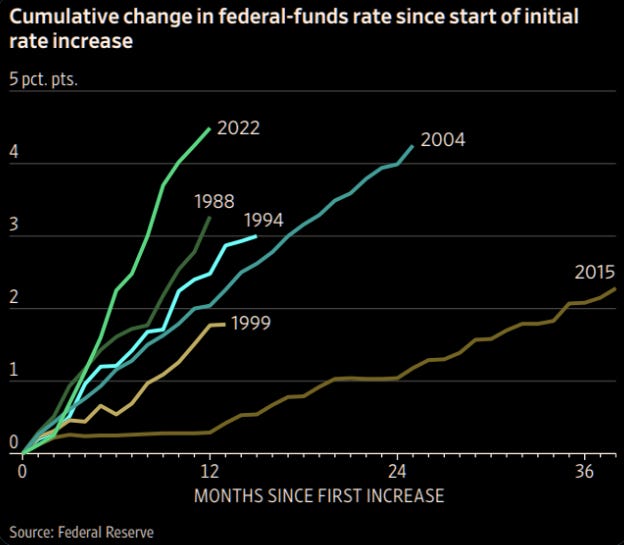

MBCC has been talking about this since most of 2022….Do we really think the largest and fastest, most restrictive tightening in history of US financial markets, as shown above, moving from 0-5.5% rates in less than 12 months, will just magically lead to a soft landing/no landing without any skeletons in the closet? Impossible!

Every rate hiking cycle has led to some eventual collapse..or bust….we saw that in 01, 07, 18, 19, 22…and still counting…This is because the Fed has engineering a massive debt bubble, a system that CANNOT take rates marginally higher than 2.5-3%, let alone 5.5-6%!!! But the Fed has no choice as we have been going on and on about, ad nauseam, inflation which was never an issue before, is now their biggest nemesis. It is the reason why they do not have an open cheque book to print yet more money to solve yet another crisis. This time it really is different! In a lot ways, worse as we are starting from an even bigger debt problem.

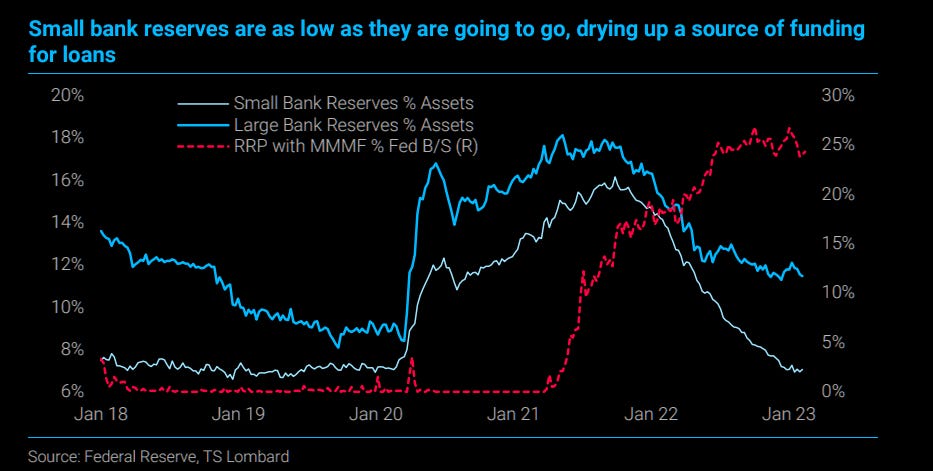

Today we are seeing the US regional banks blow up as they just dont have the same cushion as the big ones. Every crisis comes with a new part of the credit market, everyone kept saying ABS/MBS and housing are all supported, sure, but what about other leveraged parts of the market. Dominoes fall…first FTX, then Binance, then Adani Group, now SVB…one by one….

Like an old car that should be scrapped, we have been pouring more and more to keep it alive, but every $1 put in gives us less and less mileage, it is running out. Before we put in about $100 to get 80% mileage, today we need to put in $100,000 to get even 30% mileage (get the drift?). At some point, this cannot go on as the economy is NOT productive, car just conks!

So where does this leave the Fed/US central bank today….what is the trade here? Which asset class / stock / sector is the one to short here still? or buy?

Sign up below as we talk about not only macro, but the issues we picked up in REAL PHYSICAL Commodity markets as flows dictate everything and demand has been weak for months. Unlike houses like Goldman, etc etc all calling for Oil, Copper all to “eventually” rally as their “demand” assumptions are all wrong. Sure they could be right in 5 years, but Oil is down 50% and Copper down 20%, Gas is down 80%..that is no way to manage money, these are just analysts, they dont manage pnl!

Become a member today as we list BOTH tactical trades (long and shrot) and secular trades…..its about alpha near term and long term, not hold onto stale long only calls that most sell side do!