MBCC TH 13th February'23 - "Hedge Funds are ALL IN into US CPI tomorrow - what can go wrong and what are the Bond/Credit/VIX markets telling us?"

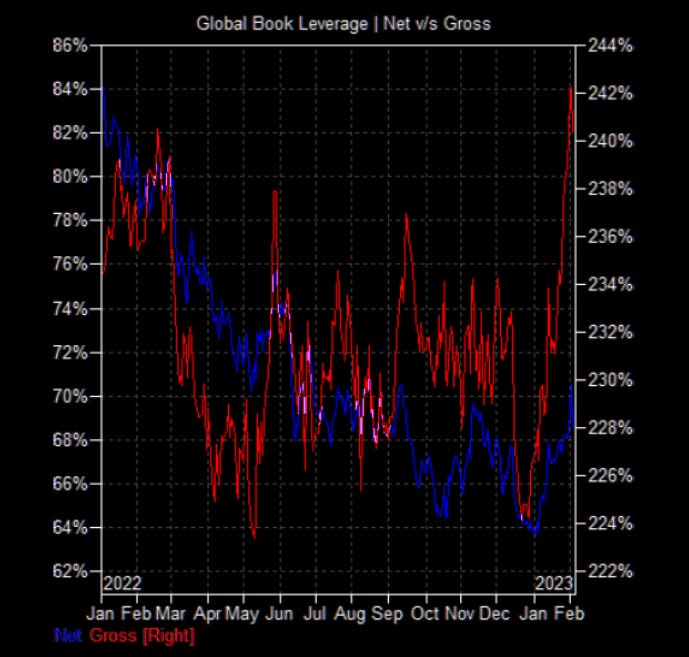

Back in November, nobody wanted to touch the market with a barge pole. Today, Hedge Funds and short term traders cannot get enough of chasing this “China reopening/inflation having peaked/Fed is done” rally. What was meant to happen in a few months has been priced in 1 month, so who is the marginal buyer or seller here? Given the performance in 2022, everyone is so “scared” to miss the bottom, that they end up chasing the narrative as it becomes self fulfilling.

Investing is all about risk/reward and positioning is all about % probability of being on one side of the trade or not. Today we discuss what the flows in Derivatives market are and how it impacts S&P 500, and then take a deeper dive into Credit spreads, Volatility curve, and Bond market structure to see what is happening in the bigger picture.

We analyse Copper, Aluminium, Coal and other Commodity markets to see what China is really up to and whether this demand recovery is real or just manipulated to stem the decline in their property sector. It all needs to add up especially if the narrative is the same one being heard across the board…We tell you where the discrepancies are and what the next trade is. Physical Commodity markets never lie, just take a look at Gas and Oil!