MBCC TH 13th March'23 - "Oil why are you still falling? Equities, is the Fed really bailing you out?"

The “HOPE” that stale Oil bulls had, “oh demand will recover as China has re-opened” or “there is an energy crisis so Oil has to go up” - all valid points, BUT Commodities are all about TIMING the narrative. There are tactical calls and there are secular calls.

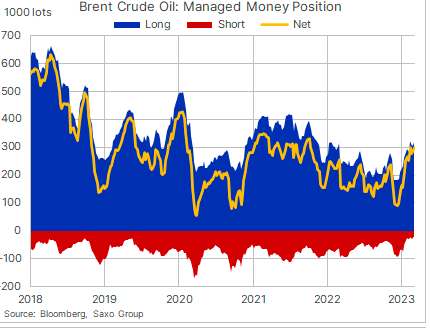

Brent Oil has fallen > 50% since last year, and bulls still hold on. COT on energy in wk to March 7 showed length held near a 17 month high at 298k lots with the long/short ratio at 14.5 not being this stretched since May 2019. False hopes?

It is not just about inventories today, but what they will be tomorrow. As our cross asset models have picked up on for the past 6 months, this “hope” is slowly coming out.

Today we also discuss what the Fed actions on SIVB mean for Bonds/Equities. Is this really a bailout? What can you still position to make money on?

Now its getting real….sign up as we have been talking about this for months!