MBCC TH 15th February'23 - "Buy Nasdaq or Buy Energy? Oil Equities lagging, Technology rallies, how much longer will institutional money take the pain despite "yield"?"

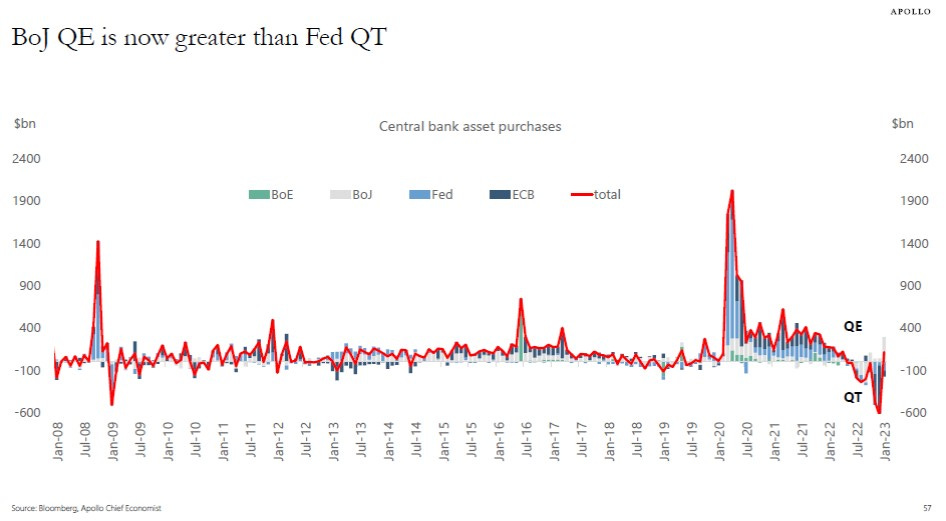

Central banks have been very naughty and this is confusing investors and traders….Bank of Japan and PBOC have injected close to $ 1 trillion of liquidity, have offset what the Fed/ECB/BOE have been trying to drain from the system. But now what are they going to do - we discuss where liquidity goes from here as that is what is/will drive asset markets.

And….

Brent Oil continues to tick lower, down another 1.5% to < $85/bbl….

Yield, yield, yield is ALL we hear from our clients. Chasing stocks/hiding their money just because it is burning a hole and chasing aggressive cyclical equities because Commodity prices can ONLY go up from here (according to all sell side research who keep taking numbers down as prices keep falling). Today you have the Vanguard Money Market Fund VMFXX now at 4.5% yield - this is a risk free MONEY MARKET FUND!

Would you be long a cyclical equity at the risk of seeing 15% eps declines for just 4% yield or a safe money market fund?

At some point, long money hiding in these names will be feeling a burn in their performance as the market makes new highs and large cap Technology names even more….tick tock tick tock…

Yield is great….until it isn’t…

We discuss what is brewing across cross assets….we analyse US CPI and what the rates/bond market is telling us - of course Equities are ALWAYS late to pick up the theme….

We share our open new live portfolio ideas……and why Gold and Silver has fallen when everyone wanted to be long 3 weeks ago!