MBCC TH 22nd February'23 - "The no landing positioning in the market, what could possibly go wrong? Nasdaq is now < 200 day, remember they said charts looked good?"

The market is driven by fickle yolo/fomo algo chasing traders, those who had good success in 2021 and those that think careers in trading/hedge funds is child’s play, one that doesn’t require any degree or experience whatsoever because lets just say….”they can read charts!”…This chart reading fad of the last decade has brewed the new generation of traders who have no concept of ev/ebitda or debt/equity restructuring or cost of capital/margins - how one should invest in a company basically! The Fed’s blatant QE and self-fulfilling prophecy made any “buy” work, which convinced them to give up their real jobs and try and make the big bucks!

Well…fast forward to 2022…..the world changed…as other than those who only read about inflation in high school/universities, no one has actually been around to trade/invest these sort of markets! The players are the same, but the game has changed…

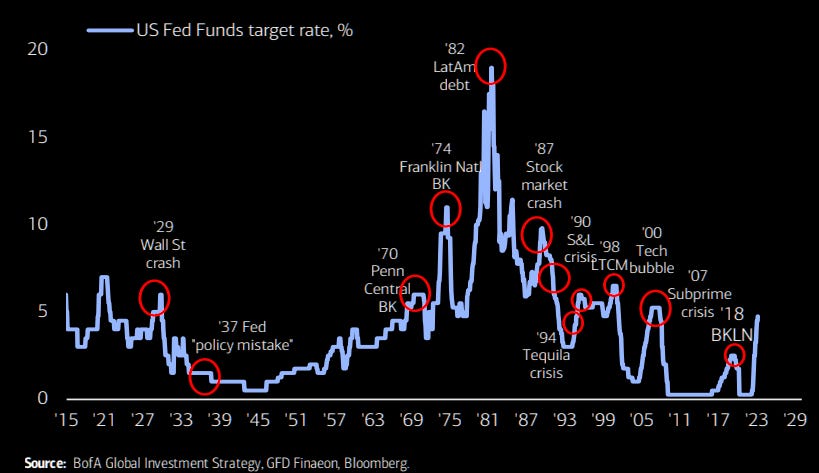

In a world of 30 trillion + national debt, fed funds at 5% (and counting) with the central bank having raised rates the fastest in 1 year and Fed’s balance sheet still around $9 trillion - do we really think this time is going to be the same?

The chart above shows how historically every time the Fed has gone on rate hiking spree, something snaps. The market is “looking through this” by saying well if the Fed is going to cut anyway, let’s just buy it now and ride it out. As the pain inflicted each time, 01 or 08 or 18 or 19 is always different. Most people, especially retail that lever can never manage to hold onto 20%+ losses and are then forced to sell at the bottom.

Also just reading charts in trendless / recessionary markets does NOT work, remember all the chart traders saying “oh tech stocks are > 200 day, so trend looks good” that only works in bull markets or one way markets. Nasdaq is now < 200 day and the weak hands that bought at the top are wondering…ask yourself why did it go up not chase because it has!

Sign up as MBCC looks at 25 different factors, and REAL physical market Commodity drivers/shipping/freight and more to tell you if the market behaviour matches the economy behaviour and other cross assets. What is happening in Oil (even though bulls keep claiming how cheap it is as China is open) and why is Copper/Aluminium/Coal all falling? How come US natgas is trading at $1.9 from highs of $10 if the world was “running out of gas”?

If there is a mismatch, then someone is wrong, and we know who that is….