MBCC TH 23rd May'23 - "It's easy to push long Oil as OPEC can cut, but will it work? Also even if the US debt ceiling is raised, what will happen next?"

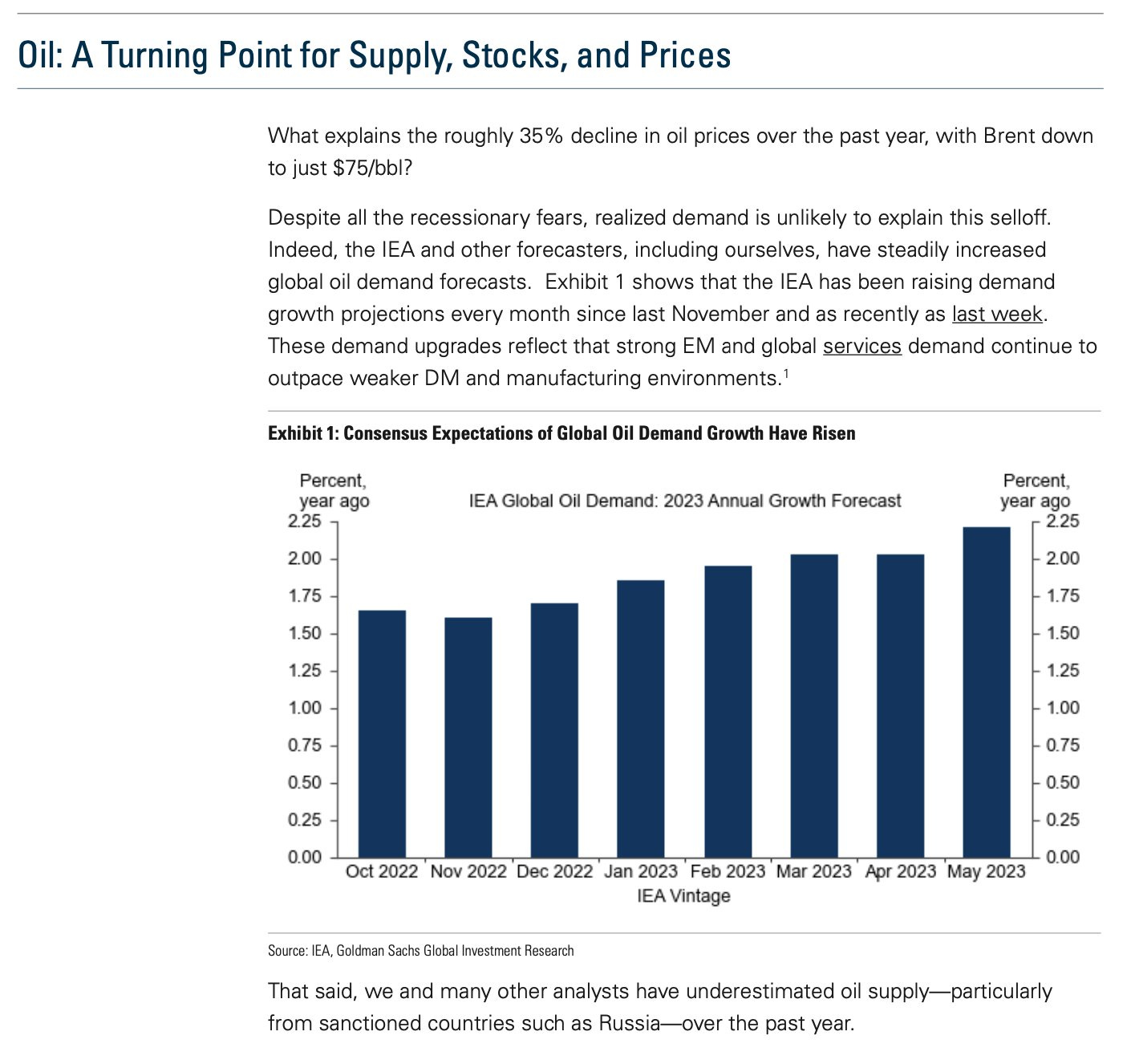

Remember back in June 2022 and Q1’23 we said MOST if not all analysts assume demand stays linear calling for Oil running out going to $200/bbl. + and then $150/bbl.+ on supposed China demand recovery that fizzled out in end q1, GS NOW are adjusting their bullish points down by admitting that demand is weaker and supply is higher, AFTER prices are down 80%+ plus! Sure, analysts never run actual PnL, it is easy to keep calling a bull hoping you might be right in 5+ years.

How does this help you when they make calls AFTER prices fall? Just like today you are seeing Copper, Iron ore all making new lows giving up all gains for the year, they key is to look at what FUTURE 3 month demand trends will BE, not what has happened.

That is what we do at MBCC as we track forward movements and tell you what WILL/CAN happen, not stick with stale demand assumptions of what has!

Remember Commodity bulls pushing Copper, Gold, and Silver are DOWN and don’t understand why, we break it down today.

Debt ceiling - everyone thinks the US cannot default, i mean it is the US after all. Sure but debt ceiling does not matter, it is what happens after. Liquidity is key and no one is focusing on that now.

One stop shop that breaks each asset class down, sign up become a member today and find out what the trade is here, we do not regurgitate news, we tell you what WILL happen based on actual physical market movements. Not hope, but fact!