MBCC TH 3rd March'23 - "What will China announce over their CCP meeting this weekend, buy or not to buy China? Liquidity, Bonds, Rates are driving the market!"

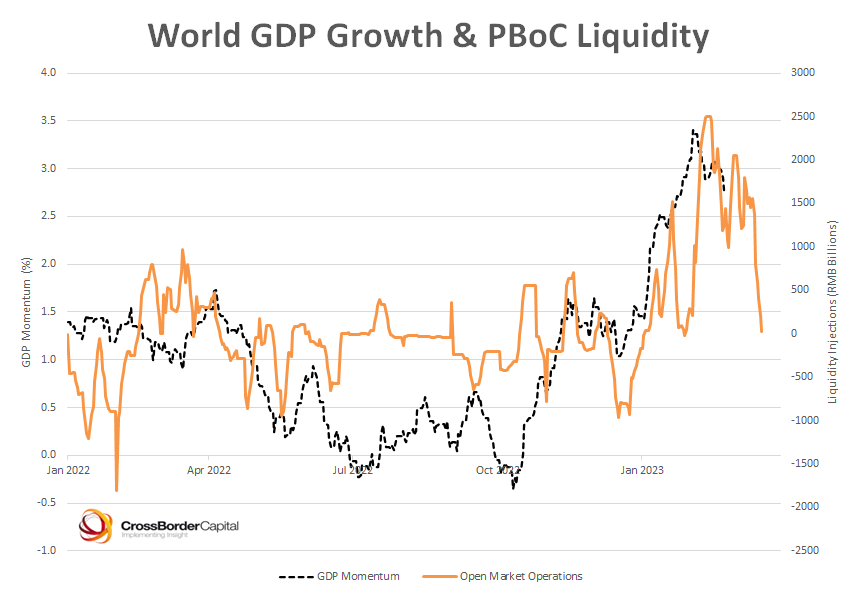

Liquidity, liquidity, and liquidity! It is ALL ABOUT LIQUIDITY. As global economy saw an injection of about $1 trillion in a few months, mostly coming from China/PBOC, that took the Global liquidity conditions index higher, led to the massive rally in Chinese markets of 30% + in just a month, as money poured in to chase the lagging markets. This at a time when central banks were talking about REMOVING liquidity. But it really is the BoJ and PBOC at fault here mostly. The chart above from CrossBorder Capital illustrates this trend beautifully. But it has since given back in February, is China done with pumping liquidity for now?

As we go into the weekend meeting for the CCP and its two sessions, we await to hear what the government has planned for their upcoming policy. There will be some key role changes to be announced but we need to keep an eye out for any changes to GDP target/growth and inflation/employment and liquidity implications.

We discuss this in our note today and what it means for Chinese markets, EEM 0.00%↑ Emerging Markets, $USD, and Copper and more. Right now liquidity is what is driving the market, NOT fundamentals.

What to do here, sign up to become a member to read more and access a live portfolio of ideas!