MBCC TH 6th February'23 - "The game behind 0DTE and what does this mean for Equities/Commodities/Dollar?"

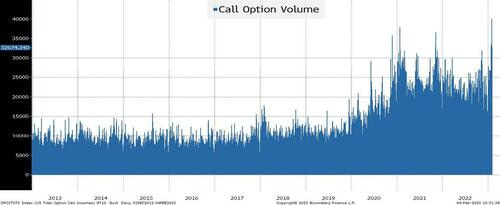

The new game in town is 0DTE, well at least for the bored day traders or rather the new generation of WallStreet bets/reddit/Uncle Sam stimulus cheque payees (whatever one wants to call them). These traders desperate to make a quick buck (aka gambling) after their losses of 2021/2022, are now trying to buy 1 day options to “call the market” and hopefully make a home run. They got tired of buying 1 and 3 month options as they lost premium. Of course we know options never work that way and are way more complex than that!

We have derivatives for 20+ years as our background, today we dive into what is happening and driving the S&P 500 and Nasdaq and what it means for risk assets. WE look at 25 different factors and when all the signs point in different directions, we know something is wrong. But of course those desperate to call the TSLA 0.00%↑ move and make 50% will jump on without knowing what it means. This is not the only name to play to actually make money, but sadly enough, it is all these traders know as they are greedy and trade the charts hoping they get it right, with no macro/fundamental understanding at all.

We update our models post the FOMC and positioning and pin point where we would be positioned in Equities/Bonds/Commodities, but more importantly we dive into what the physical markets are telling us, not just what fomo traders are doing. Their game will end in tears, investing is about being patient, not making a quick buck!

And now, the non farm payrolls came in, the reality check! What is the near term trade?