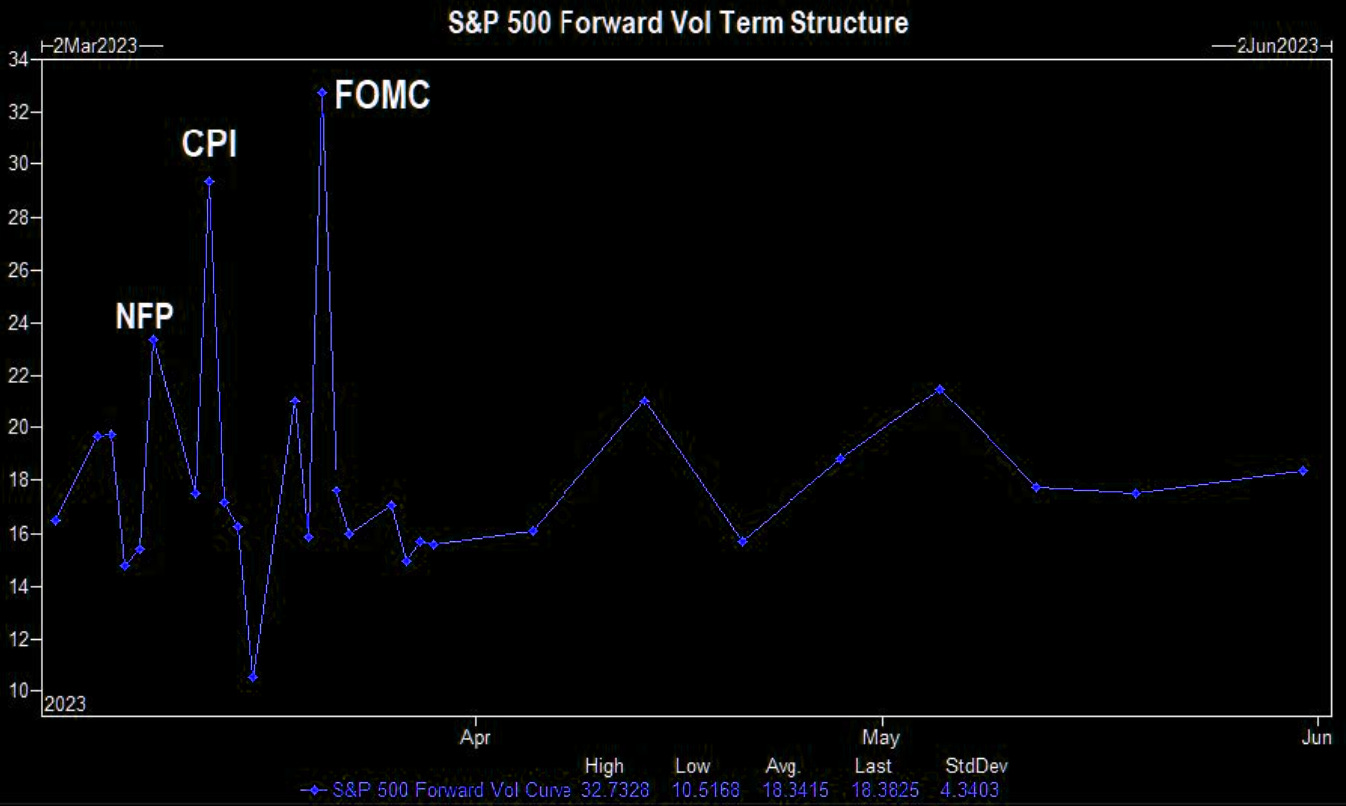

MBCC TH 6th March'23 - "The next 2 weeks will be very volatile, but watch the 0DTE flow as that can distort flow day on day!"

Everyone knows how the $VIX is muted and kept low (games banks play and more), but the above chart shows how the volatility structure is quite elevated around 3 key events next two weeks. We have the non farm payrolls, then the US CPI for February, and then the FOMC meeting later. All this has HUGE implications for the Dollar, break even inflation and then of course stock/sector asset allocation.

The Fed Dot Plot is meaningless as they just follow/react to what the macro markets price in, they have no clue, and only react, not preempt, and certainly do not try to forecast.

So, what can happen here? What is priced in? Sign up as we list out the playbook for March and what the trading opportunities are…