MBCC TH 8th March'23 - "Powell gave the Equity market a reality check, but what does this mean for Equities, Nasdaq, Commodities? Why does Oil refuse to go up?"

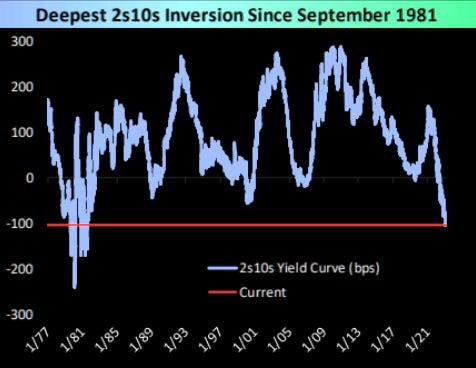

Following Powell’s surprise statement of “more work needs to be done” and “we will look to higher rates if need be”, the Bond market got rattled as the 2 year/ 10 year curve as shown above, moved down to -100bps, the widest sine 1981! What is going on in the Bond markets? Why is the Equity market so resilient for now? We discuss the financial flows and drivers causing this and what can change it? Is this time really different, we tell you what our cross asset models are pointing to and what to do here.

Oil prices refuse to go up with the market and fall more when Dollar rallies/Bonds fall - why is that? We discuss physical flows and drivers. As we said back in October 2022, it is not about what inventories are that day, it is about WHERE THEY WILL BE in the future, that is what dictates prices. Today the bulls are giving up as they see lower demand, but that is after a 50% price fall.

We pick up on pricing discrepancies in Bonds/Equities/Commodities/Credit and open new trade ideas into March here