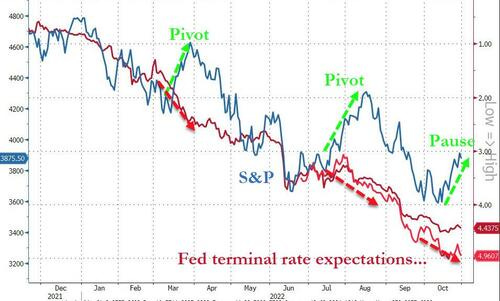

MBCC Trading Highlights 1st November'22 - Are central banks really stepping off the rate hike pedal here?

The chart above (source Zerohedge) shows the state of the market going into the Fed FOMC tomorrow, it explains the mood exactly. The blue line shows how the S&P 500 is rallying on hopes of a Fed “pivot” whereas rates/bonds and Fed rate expectations (red line) are moving higher. There seems to be a bit of a disconnect, but as per the last few FOMC meetings, the market tries to rally on hopes that perhaps the Fed will blink now given how much pain is in the system. But what investors/traders fail to realise is that going back a few cycles, we are nowhere close to. being any where near neutral levels as the market has been on a one way up trend for decades, thanks to the Fed’s liquidity.

Truth be told, the Fed really has NO clue what to do, they have always played a reactionary role, never a pre-emptive one, i.e. they react only to emergencies. So with that being said, to call the Fed pivot today when data is nowhere close to being at their target and inflation being so high, does not make sense. They will as usual say “we have tools to act and we watch the data closely”. One has to gauge how/what will drive inflation to assess when the Fed will be done.

But here are some technical factors driving the market right now, what does this mean for Dollar/Bonds/Commodities and year end asset / stock allocation?

Sign up to read more with live portfolio ideas as to what our cross asset models tell us over the next 3 months and what is the risk/reward here? These are not investable markets, these are trading ones…for now….