MBCC Trading Highlights 3rd January'23 - "We look at the risk/reward of all assets, how should you be positioned?"

Most investors over the past decade have been advised by their advisors to buy into the 60/40 portfolio (60% Equity and 40% Bonds). This proved to be a great strategy as Bonds tended to hedge any Equity performance, closing the year positive even if the latter was down on the year. But then again, these same advisers, never ran the analysis or correlations going back 3 economic cycles, or at times where there was inflation like in the 70s. Low and behold, in inflation, BOTH equities and Bonds get hit. So it was not magic, it was more luck than science. Actually it was because the Fed had been printing magic money since 2008 and that caused this strategy to work.

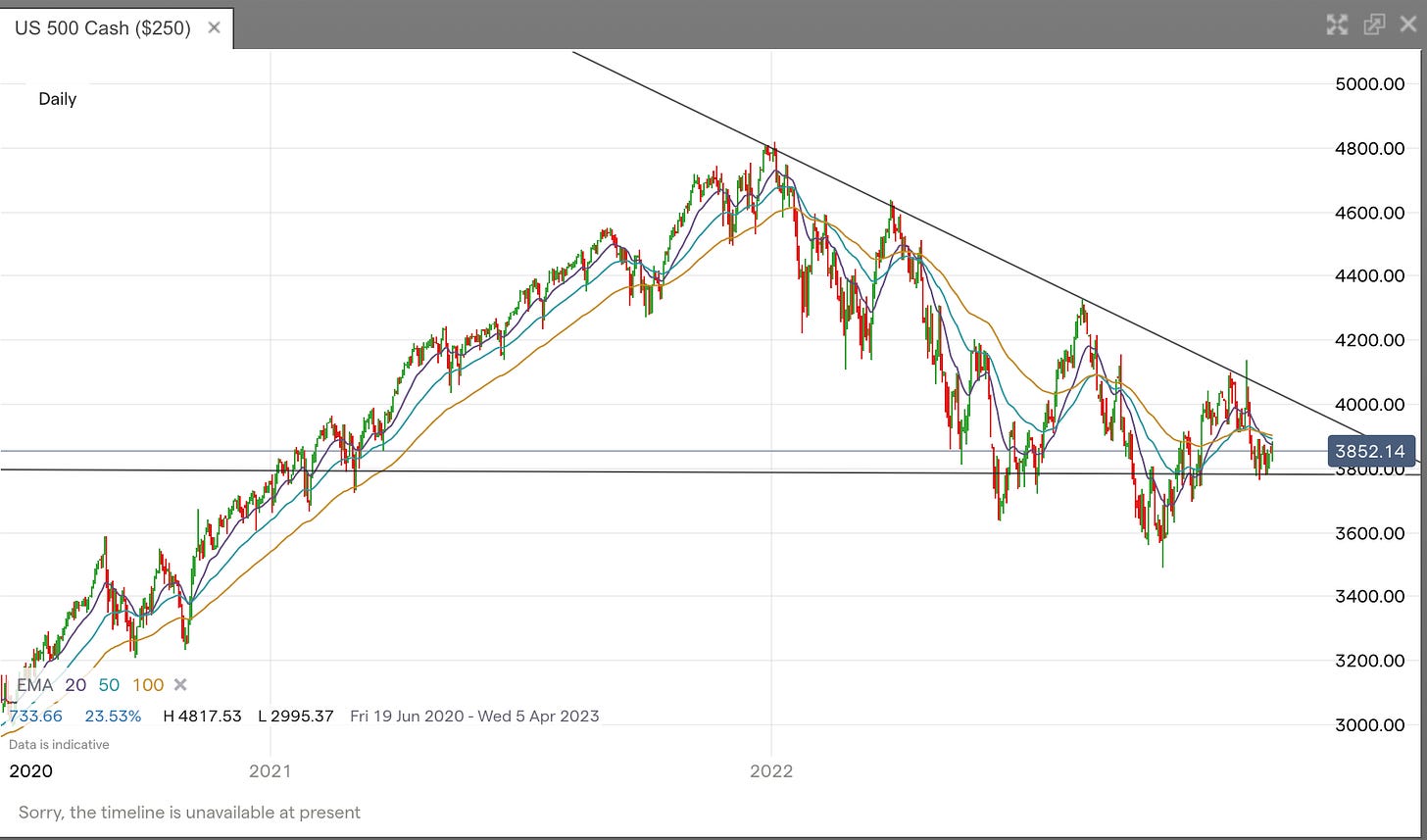

Equities are claimed to be cheap, or how this is the most priced in recession even. But then again, Equities are always cheap, it was never about that. We look at the key drivers that drive Equities like Earnings, Multiples, Valuation, Growth rates, and Liquidity. So whether it has fallen 20% or 40%, the answer is not that straightforward.

We are at the start of a new paradigm of investing in 2023, something the new generation of traders since 2020 are NOT used to. It will be back to picking stocks, looking at balance sheets, and timing the economic cycle to get performance. It will not be just a buy and hold that they are used to.

The old adage goes, “do not fight the Fed”. These new generation of investors may be better served if they actually listen to the Fed rather than project what they wish to happen.

Sign up as we outline what can happen in 2023. Will the 60/40 portfolio work in 2023 after one of the worst performances in 2022? Where will the S&P 500 go from here? Are Commodities cheap or expensive, and what are the physical markets telling us?