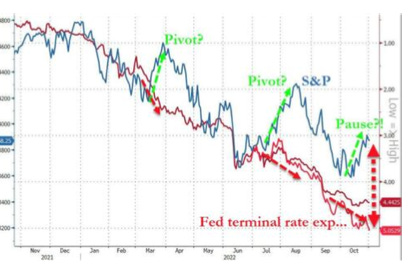

MBCC Trading Highlights 3rd November'22 - It is ALL about the terminal rate, why did Equities sell off?

The market rallied on hopes yet once again expecting the Fed to pivot and pullback from their tightening stance, with the Dollar lower, Bonds higher, and all risk assets higher into the FOMC. As we had said, it was pre-emptive and we said that we would be fading the rally purely because the Fed was nowhere close to pivoting.

Powell in his press conference said “...pausing is not something we're thinking about...the labour market continues to be out of balance, with demand substantially exceeding the supply of available workers” reinforces the notion that the Fed is looking at both employment and inflation as giving it plenty of reasons to keep tightening. The problem is that the Fed really has no justification to stop tightening as the data is very inflationary and until that comes close to their 2% number they will not stop. Even though the market rallied on the headlines that they will take cumulative rates into account, it thought that meant that the Fed would be done/slow down. Now, the Fed may not raise by 75 bps each time, of course as before rates were closer to 0%, so they had to increase fast because they know they will need to cut at some point when the economy slows. Now that rates are around 4%, they can tighten in smaller increments, but make no mistake, the Fed is STILL tightening mode. So getting excited about 25 bps less does not mean risk on markets. The market is too obsessed with rate of change but instead it needs to focus on net liquidity which is being drained and that is bearish overall.

Where can we go? Why will Gold and Silver not rally still? What is the trade in Oil here? All this and more…