MBCC Trading Highlights 7th December'22 - Oil equities are finally waking up, or rather, getting a reality check, cheap can ALWAYS get cheaper!

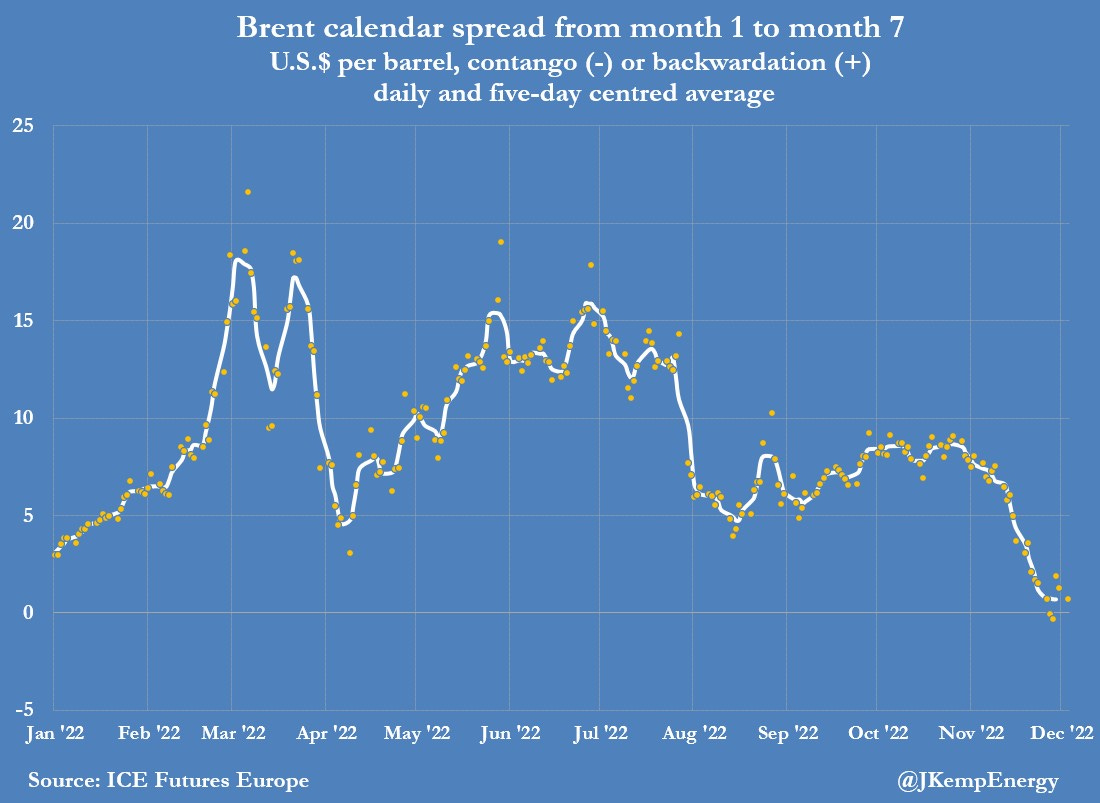

The chart above shows how the Oil market extreme backwardation has NOW moved into a contango! This has been one of our KEY calls these past few months/year, all the money was hiding in Energy/Value as everyone was convinced Oil is going to $200, chasing the. “value” trade. But we argued that once Oil falls, and it did, and continues doing so, equities always trade at a LAG, as they are in denial. Equity long only or analysts keep thinking the price floor of Oil is $80 or $90, and OPEC will never let it drop, but it never works that way. Especially during recessions or when demand falls. It is out of their control! OPEC is ONLY good at controlling supply, not demand. This is the issue with the market! Demand has been the key variable and most assume demand would stay constant forever. The demand surge post Covid reopening was NOT normal.

Commodities are all a TIMING game, but analysts are too lazy to see what is going to happen, but just keep chasing what has. They do not run money so it is easy for them to call something “cheap” and push buys all the way from $130 down to $80, as they do not have pnl to worry about. They may be right at some point in the future, but can you as an investor hold on?? That is the issue, risk management and risk/reward!

We spoke about Cross asset arb, and how we have spent years developing Commodities/Equities models, it is not as easy as going long one and short the other, it works but in very specific situations with a host of parameters. It is about the alpha, as BOTH can fall, like today, people are buying the Oil but it falls more. Why not sell the Oil stocks, you have 50% in your favour!

Long only money that has been hiding in “value” and energy stocks are slowly waking up and sector rotation is what is driving this market!

Commodities cannot be looked at in isolation, our goal is to see merge macro trends/themes/cycles and use our cross asset model signals to time what we see i the physical markets to really zero in on trades. How much downside does this have?

Sign up to find out our positions and what our targets are!