MBCC Trading Highlights 9th November'22 - Where can the consensus be wrong? All eyes on CPI tomorrow...

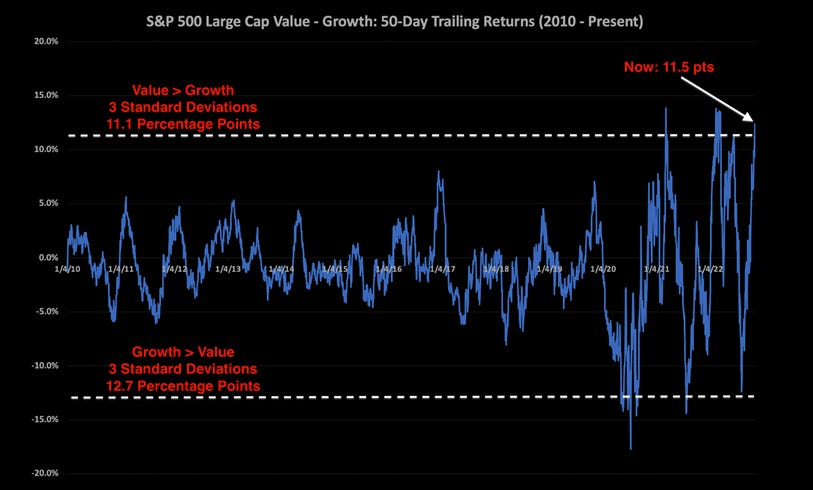

The above chart shows how $$ has moved out of Growth and into Value, we are at a 3 sigma extreme. Of course with no place to hide, everyone sold their Technology longs and parked it into Oil longs, as it was the only area of strength recently given supply shortfalls, so positions are quite extreme. Now we analyse the area of strength in Oil today and what really drove the prices higher over the past few months. It is a combination of a very shrews OPEC+ mixed with Fed stimulus and Russian bans on products together with some maintenance. The wonders of Commodities, they are all about timing, but as always, after some time, one side plays catch up. The key is to figure when the pendulum swings the other way.

China buys low and sells high. Today we saw even one of the biggest bulls whose previous talking points were about supply running out/lack of production etc. walk BACK on their view and be open to perhaps demand not coming back. As usual time spreads today do not tell you what WILL happen, just what has. We look at our forward macro indicators to tell you what is GOING to happen based on the lead/lag effect.

We break the barrel down and tell you where Oil prices go next. There is a catalyst brewing. What is really driving Oil and what is our target? But of course the generalist will only want to hear about “yield” “value” etc. Equities are cheap, sure, but cheap can always get cheaper.

Where do we go from here? How to be positioned here? The ultimate trade for Q4. Sign up below.